Toronto Real Estate Market Stats - March 2024

As the first quarter of 2024 draws close, the Toronto Regional Real Estate Board (TRREB) has released its latest Market Watch report, providing a valuable snapshot of the Greater Toronto Area (GTA) housing market.

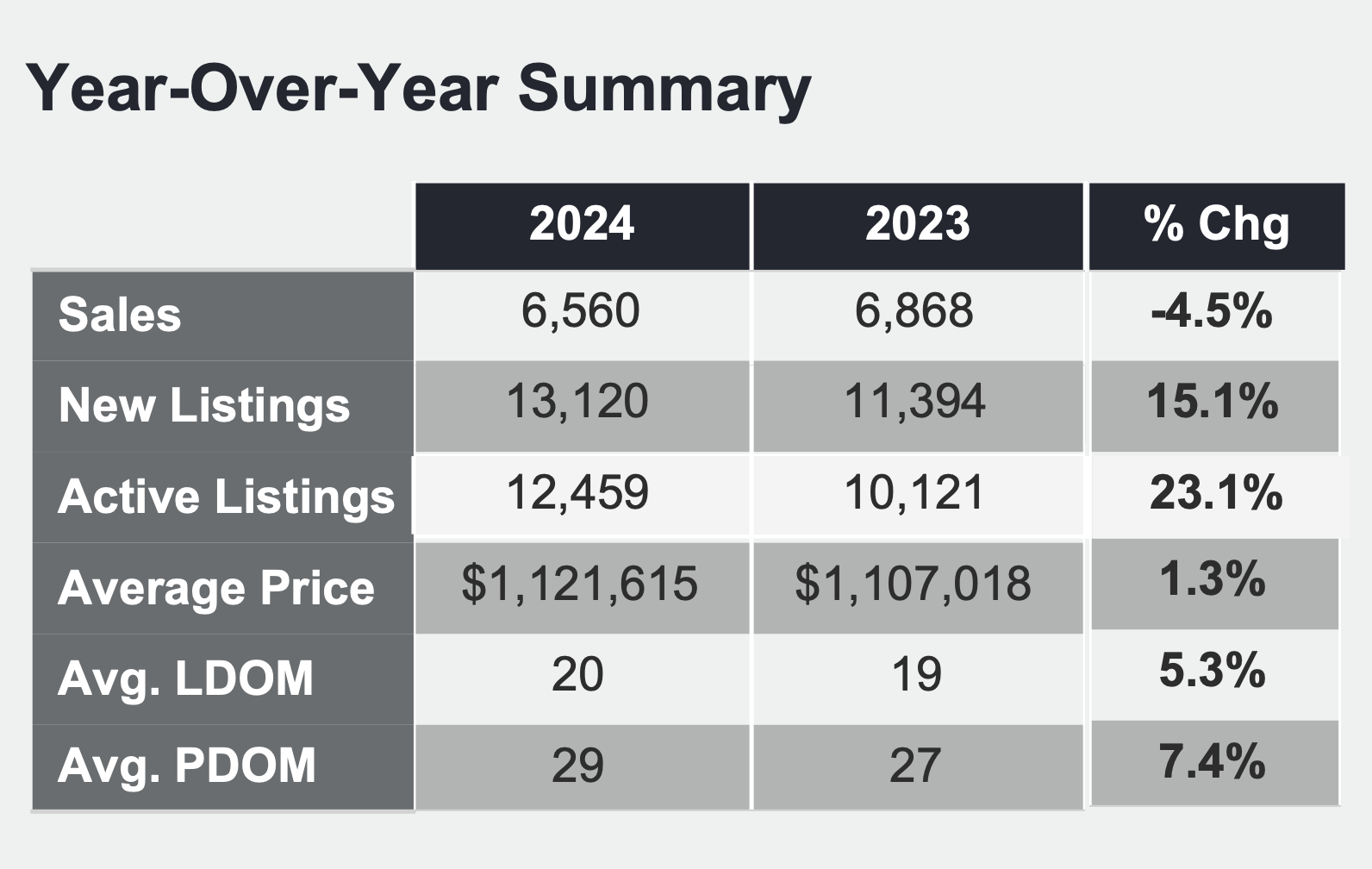

Statistics at a Glance

Economic Indicators and Their Influence

The economic landscape, always a critical backdrop for the housing market, presents a mixed bag of indicators. A modest growth in real GDP at 1.0% in Q4 2023 suggests a steady, albeit slow, economic recovery. Employment growth in Toronto has been more encouraging, with a 1.7% increase in February 2024, a positive sign for housing demand. However, the unemployment rate remains at 7.1%, and inflation at 2.8%, combined with higher interest rates (Bank of Canada's Overnight Rate at 5.0% and Prime Rate at 7.2%), poses challenges to affordability and borrowing.

Market Dynamics: A Closer Look

March 2024 saw a decrease in home sales by 4.5% compared to March 2023, with 6560 sales reported through TRREB's MLS® System. Despite this slight downturn, there's a silver lining: new listings increased by 15% year-over-year, hinting at a better-supplied market. The sales-to-new-listings ratio indicates a market that's gradually becoming more balanced.

The average selling price in March 2024 increased moderately by 1.3% year over year to $1,121,615, reflecting continued resilience in property values. This is further supported by the MLS® Home Price Index Composite, which inched up by 0.3% compared to last year.

Segmented Market Performance

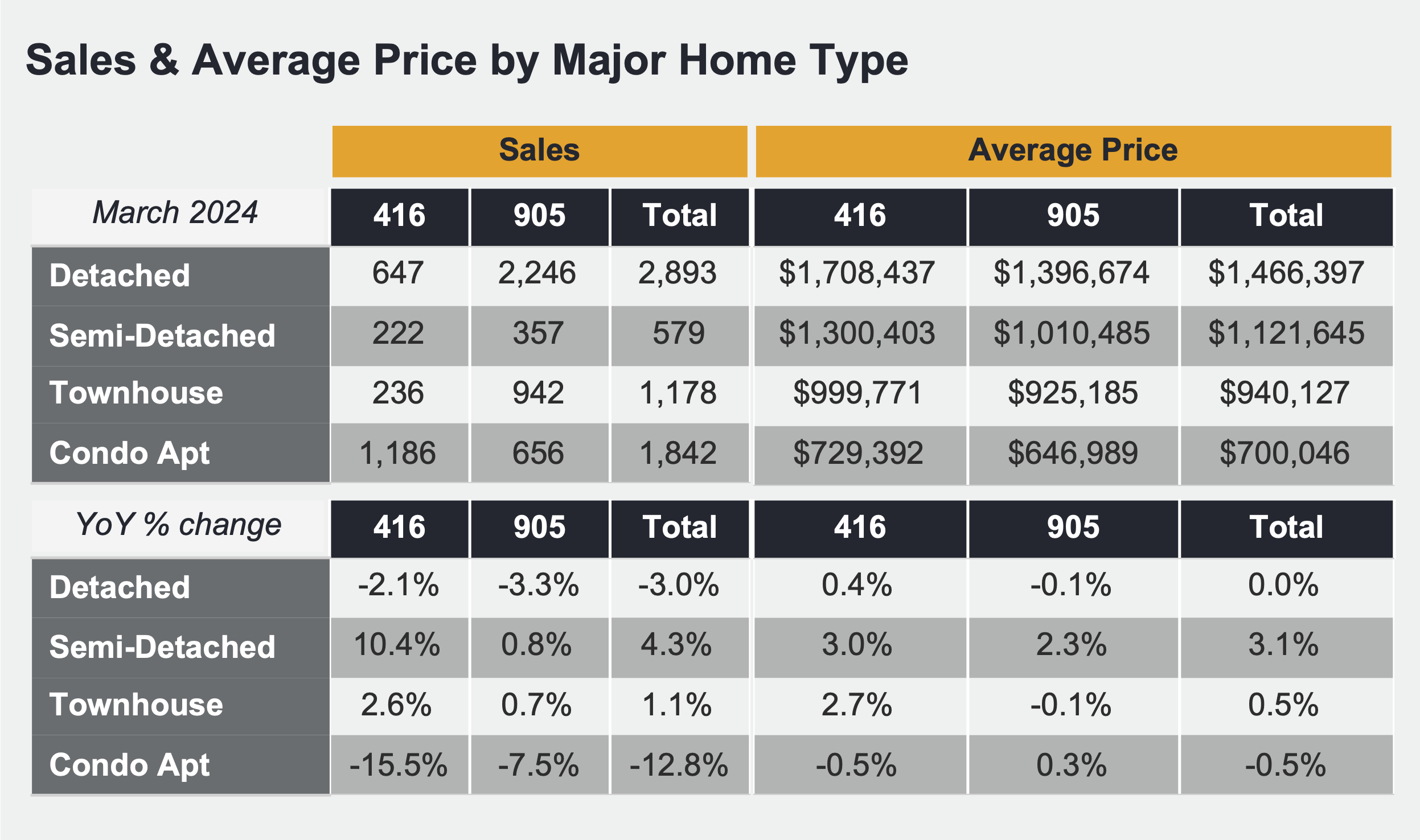

The performance varied significantly across different market segments:

- Detached homes in both the 416 and 905 areas experienced a slight decrease in sales but saw an uptick in average prices, signalling sustained interest in spacious living amidst remote work trends.

- Condo apartments, particularly in the 416 area, faced a notable drop in sales and a reduction in average prices, suggesting a shift in buyer preferences or a recalibration of the condo market.

Strategic Insights for Buyers and Sellers

For buyers, the increased inventory and slight softening of prices in specific segments present an opportunity to negotiate more favourable deals. The emphasis should be on thorough market research and readiness to act swiftly when the right opportunity arises.

On the other hand, sellers might need to recalibrate their expectations and pricing strategies, especially in segments experiencing slower movement. High-quality, well-marketed listings that stand out in the digital space are more likely to attract attention and command better prices.

Looking Ahead: The Spring Market

As we move into spring, traditionally a period of heightened activity in the real estate market, several factors merit close attention. Economic and banking experts have hinted at the potential for lower borrowing costs, which could inject renewed vigour into the market. The continued focus on increasing housing supply through measures such as encouraging gentle density and innovative ownership models will be crucial in shaping the market's trajectory.

Conclusion

The March 2024 TRREB report spotlights a market in transition, influenced by broader economic currents and evolving consumer preferences. While challenges persist, especially around affordability and supply, there are opportunities for both buyers and sellers willing to navigate these complexities with informed strategies.

Partnering with a knowledgeable real estate team is more important than ever for those looking to enter or move within the GTA housing market.

As we continue to monitor the market's development, we focus on leveraging our deep understanding of local dynamics and innovative marketing approaches to deliver exceptional value and results for our clients.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "