Toronto Market Update - July 2022

GTA HOME SALES AND LISTINGS TREND DOWNWARD

Should we panic? Run for the hills? Pack up and move West? NO.

There is a lot of uncertainty surrounding the real estate market in the Greater Toronto Area right now. I'm going to give you the stats, facts, and my opinion on what's going on.

First, the stats. We'll start with the Greater Toronto Area as a whole and then narrow in on Toronto after.

I use both condos and freehold homes in my data.

STATISTICS

You can use your mouse or finger to hover/click on the bars for $ values. 👇

- Last month the Greater Toronto Area had an average price of $1,086,227. This is an increase of 1.85% over the previous year however, it's also a decrease of 5% over June 2022.

- The days on market have increased 27% to 19 from 11 last July.

- The amount of properties sold is down 49% over the same month last year.

👉 DOWNLOAD THE FULL REPORT HERE 👈

- Last month the City of Toronto had an average price of $1,035,565. This is an increase of 1.97% over the previous year however, it's also a decrease of 10% over June 2022.

- The days on market have increased 14% to 16 from 12 last July.

- The amount of properties sold is down 37% over the same month last year.

👉 DOWNLOAD THE FULL REPORT HERE 👈

OPINION

The numbers are scary. We're seeing real estate gains essentially set back an entire year because of several different factors at play in the world. Add inflation to the mix and homeowners have valid reason to be concerned.

The war in Ukraine, extreme inflation (who thought printing money would do that eh?), interest rate hikes to help with said inflation, and a post-pandemic summer with no restrictions are all factors affecting the market right now. The media keeps telling us that a crash is imminent but I'm not so pessimistic, yet.

REASONS TO NOT PANIC

1. POST PANDEMIC SUMMER

The first reason I'm not panicking yet is because we're experiencing our first full summer with no restrictions since 2019. That's a long time to go without a proper summer and a lot of people are taking advantage of it. You've heard the Pearson Intl Airport stories, surely. People are out and about enjoying life again. Folks that planned on buying a home are taking a break to enjoy the outdoors. Once the summer is over it's my belief that we'll see a big bump in buying activity again.

Additionally, the summer is ALWAYS slow in real estate. We're used to this dip every summer. It's not 'too' unusual.

2. INTEREST RATE HIKES

The Bank of Canada (BOC) has been aggressively raising interest rates to fight inflation. When the BOC raises interest rates everyone becomes much more cautious with their spending. After a while, people adjust and begin spending again. We're in that adjustment period right now.

3. THE STOCK MARKET

The S&P 500 has been in bearish territory for the last 6 months. This month we're seeing the beginning of a reversal in that sentiment. It's still too soon to tell if the rally will keep up, but it's a good initial indicator that economic recovery is on the way.

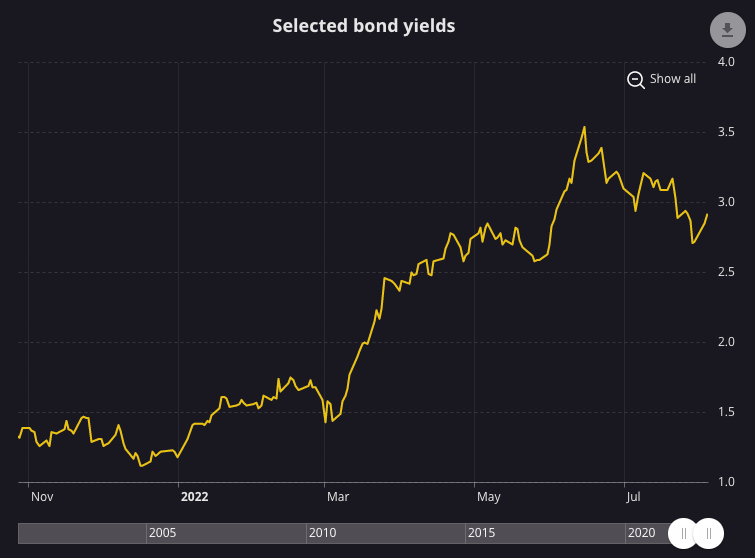

4. BOC BOND YIELDS

The Bank of Canada market bond average yield is currently sitting at 2.92 on the 3-5 year. That same bond was at 3.54 in June. The bond yield and fixed rate mortgage are related. When the bond yield drops, so do fixed rate mortgages. The image below shows us that the bond yields are dropping, which means fixed rate mortgages are as well.

This is a positive sign (if it stays that way).

Any questions? Contact me below.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "